GBP / USD: strategic sale of above 1.65 – SocGen

“The Scots seemed to be” no “, and a two-week volatility in the markets should settle down, even if the long-term consequences of the vote will still be felt. Judging by the amicable tone Yellen, the Fed steadily nearing completion period of quantitative easing (QE) and zero rates. All of this will benefit the dollar.

So far, the reaction of the stock, credit and emerging markets on QE was more alive than at the time of tightening in 2013, however, it seems, USD will rise against the currencies of G10.

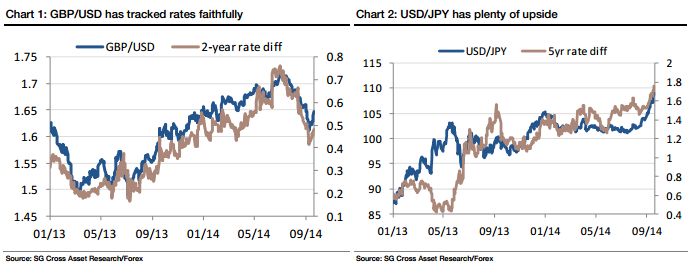

Pair GBP / USD is waiting for strategic sale above $ 1.65, and the next target of USD / JPY would be 110.50. Among the positions on EUR / USD is still dominated by short, but a disappointing result of the program target long-term refinancing (TLTRO) will cause pressure on the ECB on the introduction of additional incentives. NZD was sensitive to news about the election this weekend, and it remains short against the USD and AUD. And after the elections in Sweden, which took place last weekend, we adhere to the “bullish” sentiment in pairs USD / SEK and NOK / SEK. “- Argues Keith Jukes, an analyst at SocGen.