9 facts about debt bubbles and oil prices

The cost of oil and other commodities in recent years reduced. Is it good or bad for the world economy? Uniquely difficult to answer, but so far everything is going to ensure that the current trend may be a harbinger of something more dangerous.

Falling oil prices may mean that the debt bubble that grew up in a very long time, at least since the end of World War II, will not be able to continue to expand. And when it burst, the world economy faces enormous challenges, experts said Oil Price.

Many believe that the drop in oil prices due to the fall in the value of production, so long as the real cost reduction can not be afraid. This is a misinterpretation, as with oil falling prices of many other commodities. And when prices are set on the world market, the biggest challenge is the availability. Even if the food, oil and coal in terms close to those needs, consumers can not pay for them more than they can afford.

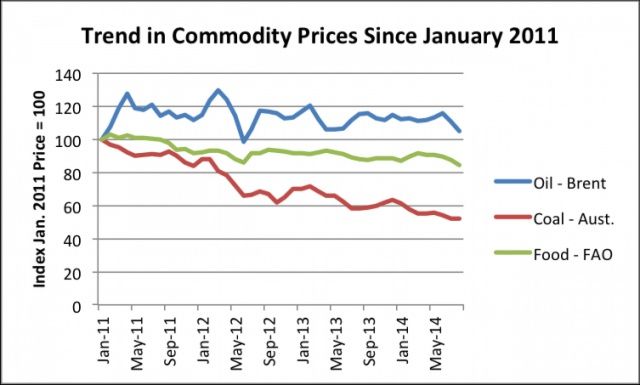

If you look at the chart, we can see that the price of Brent, the Australian coal and food decreased synchronously. This decline continued in September. Now Brent is trading at $ 97.25, while in August the average price was $ 105.27. It was this last fall, many were concerned.

Considering the causes of decline in the value of the goods, you need to know a few facts.

Fact №1. In the short term, commodity prices do not reflect the cost of production

They reflect the price that consumers can afford.

Oil prices are set on a global basis, while the cost of production varies in different regions. Therefore, the international oil prices as a whole can not fully meet the cost of production.

If oil prices fall, it is tempting to believe that this is due to the fall in the value of production. But many manufacturers say that the current oil prices are too low.

In the short term, low prices, is likely to indicate that the world market decreased demand. Commodities such as oil and food, usually in high demand. Why they became less necessary? The answer to this question is the availability.

Availability depends on the income and debt. Revenues tend to be quite stable. That is, the availability can be reduced by slowing the growth of debt.

Fact №2. Economic growth tends to create debt bubbles

To achieve the most effective economic growth requires a combination of the following factors: the growth of debt, cheap fossil fuels, cheap non-fossil fuels, technological innovation.

In this case, the debt will continue to grow as the economy grows. Unfortunately, this growth is only temporary, because the resources are gradually becoming more expensive with a growing economy.

The problem lies in the cost of resources, is the fact that, as a rule, the first to use the resources that are cheap to produce. That is, technological innovation continues to occur, but the decreasing production of increasingly stringent requirements for the technology to contain costs. In the end, the cost of resources goes up too much, and economic growth is slowing, but had already created a huge debt load.

Using debt has several advantages:

the consumer can buy the final product, created using fresh resources, suggesting that the final product is not too expensive compared to income

resource companies can get the money needed to purchase equipment and hire workers,

companies can build factories, to the point as to accumulate funds for the construction,

government can fund the establishment of the necessary infrastructure, the demand for resources, increasing their rates to a level that makes the business profitable resource extraction.

Fact №3. Repayment of debt is difficult in the fall of the economy

Once economic growth stops or slows down too much, the debt bubble has a tendency to break, so as to repay the debt with interest by a decline in the economy is harder than when growing GDP.

Governments can hide the problem for a long time by rolling over old debt and lower interest rates to almost zero. But at some point, probably, the system is doomed to fail.

Not all debts are the same. Debt, which creates bubbles in the stock market, has little effect on commodity prices.

However, any changes that lead to a reduction in global trade, pushing the economy to the compression and make it more difficult to repay the debt with interest.

Thus, the sanctions against Russia and Russian sanctions against the United States and Europe are likely to push the world to the debt collapse.

Fact №4. Rising raw material costs – a problem for importers

If the price of oil increases, and if the cost of food rising, wages are not growing as fast. Ultimately, consumers reduce the volume of purchases.

Can be implemented in a scenario that we saw in 2007-2009., When falling house prices, the banks had problems, and many have lost their jobs.

Fact №5. Reduced price – it is a problem if you do not drop the level of production

If commodity prices fall, for any reason, it will affect the volumes that companies are willing to produce.

There will also be a tendency, associated with the reduction of the new production.

If prices fall too far, some companies will leave the market entirely.

Oil-exporting countries are heavily dependent on oil revenues, which are high, unless the high oil prices.

If revenues are lower, they are likely to reduce a variety of programs, including important from a social point of view, and without such programs may have disorders that can lead to a reduction in oil production.

Fact №6. Growth in sales of oil to China due to increased debt

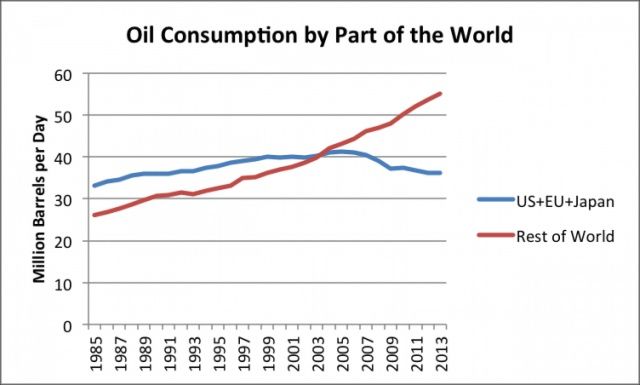

Growth in oil consumption in the world in the recent past has been associated exclusively with the growth of consumption in China and other emerging markets, and that caused by high oil prices.

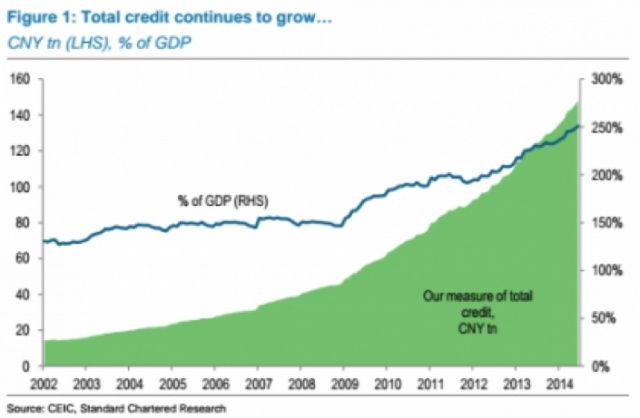

But, for example, the total debt in China grew at an appalling rate in recent years, including by the shadow banking system.

Now the growth of debt, it seems to be slowing. Most likely, this is also reflected in the global demand for oil and other commodities.

Other emerging markets also do not feel very good. Since 2008, the United States, Europe and Japan pursued a policy of easy money, and some of these funds were directed to emerging markets.

But now, when the Fed’s stimulus program comes to an end, investors are taking a more cautious approach to new investments due to a possible rate hike in the United States.

If interest rates rise, loans become less available, and therefore also reduce demand.

Fact №7. Debt bubbles caused crises in the past

Forbes commentator Jesse Colombo says that the Great Depression was largely the result of the debt bubble created during the 20’s. Another, more long-term reason could be the loss of jobs in agriculture.

A combination of bubble debt and job losses may be parallel to the current situation.

Many believe that the housing bubble in the housing market contributed to the Great Recession, and its creation starred spike in oil prices in 2007-2008.

Fact №8. The collapse of the bubble will lead to a drop in prices

If the debt bubble bursts, it is quite possible, the prices of many commodities will fall. This can lead to problems of many suppliers of different types of energy.

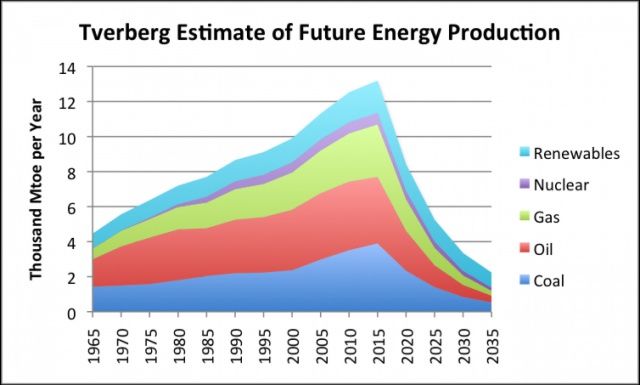

The graph shows a very rough estimate of the reduction in energy consumption as a result of the collapse of debt and falling prices for most fuels simultaneously.

Obviously, the government will try to prevent another sharp drop in commodity prices. The question is whether they will be successful in their actions, and how long they will be successful.

Fact №9. Debt – an integral part of the financial system

Now the debt is a necessary part of the financial system. Can not produce the necessary amount of resources without permanent raise financing for new projects.

The problem is that as soon as the resource cost becomes too high, a system based on long, no longer works.

If, however, prevent the collapse of the current system, the new system is likely to be similar and work better it will be.

Create a new system, where there is no need to produce energy, it is impossible, as even modern “renewables” are part of the fossil fuels. It is unlikely that anyone would want to return to a time when mankind has not learned to use oil and gas as it is now.